CBS News Live

CBS News New York: Local News, Weather & More

Watch CBS News

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

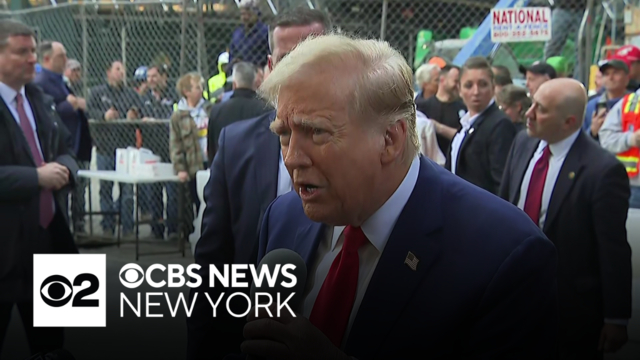

Former President Donald Trump visited a construction site in New York City before returning to court for his alleged "hush money" trial.

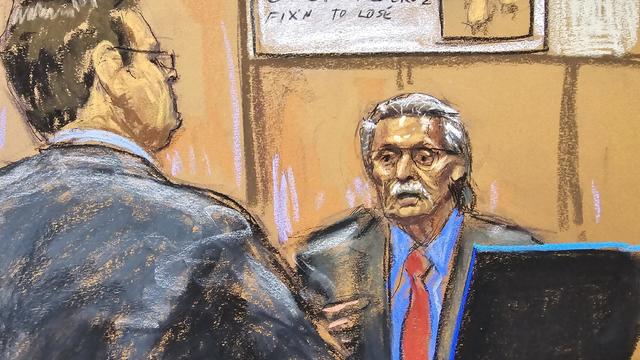

Former National Enquirer publisher David Pecker is expected to continue testifying in Donald Trump's New York criminal trial, his third day on the stand.

As Columbia University's pro-Palestinian protest continues, New York City Mayor Eric Adams says there's no need to call in the National Guard.

Authorities with several law enforcement agencies searched an area in Manorville Wednesday for evidence in the Gilgo Beach murders case.

As Israel's leader equates U.S. university protests to rallies in Nazi Germany, Palestinian students tell CBS News what the support means to them.

Two heroic men saved a little girl that was running into into a busy intersection in East Hartford, Connecticut.

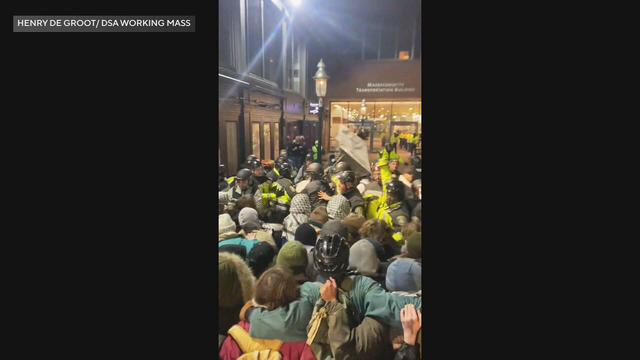

Boston Police arrested more than 100 people as they cleared out pro-Palestinian protesters and their encampment from Emerson College early Thursday morning.

Former MIT researcher Qinxuan Pan has been sentenced to 35 years in prison in the 2021 murder of Yale graduate student Kevin Jiang.

CBS New York hears from New York City Mayor Eric Adams about the law enforcement response to the pro-Palestinian protests at Columbia University, NYU and beyond.

Former President Donald Trump visited a construction site in New York City early Thursday morning, before returning to court for his alleged "hush money" trial. CBS New York's Natalie Duddridge was there for what he had to say.

The school has given students a Friday deadline to clear their pro-Palestinian encampment from the main lawn. CBS New York's Christina Fan reports on the negotiations.

The former president will be in a Manhattan courtroom for witness testimony in his "hush money" trial, as the Supreme Court hears his presidential immunity case. CBS New York's Elijah Westbrook has the latest.

CBS New York's First Alert Weather Team has the latest forecast.

A great investigative news tip should explain the situation in detail, be newsworthy, and have real-world consequences.

Many romance scam support groups are full of people making other questionable promises of recovering funds, the CBS New York Investigative Team found.

The DOJ is threatening to sue the NYPD if the practice of parking on sidewalks and crosswalks continues.

A New York City company promoted "$0 cost" COVID tests, then got over 100 complaints after people were told they may owe hundreds.

One year ago, a deadly New York City parking garage collapse sparked calls for increased oversight, but CBS New York has found inspections are past due for hundreds of garages across the city.

One person was killed and five others were injured in the parking garage collapse on Ann Street in the Financial District on April 18, 2023.

Three New York companies say their bills are being ignored after lighting up Citi Field for the Amaze Light Festival.

A new report from the NYPD's court-appointed monitor says the department still has plenty of work to do to address racial disparities in policing.

Local researchers are studying what a similar impact would mean for area bridges and shared their findings with CBS New York.

New York City's Open Streets program is back for the 2024 season, which means regular street closures across the five boroughs.

One year ago, a deadly New York City parking garage collapse sparked calls for increased oversight, but CBS New York has found inspections are past due for hundreds of garages across the city.

The Red Bank Police Department bid farewell to two beloved veteran K-9 officers, who are retiring.

Some Queens residents are fuming over cars parking on beloved greenway.

The 12th Annual Black Comic Book Festival returns to the Schomburg Center later this week.

There are plans to turn an Inwood parking lot into new affordable apartments for the community.

From affordable housing to commercial properties, New York City developers are addressing the climate crisis in a variety of ways.

A New York City organization is taking action to clean up drug needles and syringes littering a South Bronx park.

Brooklyn Charter School in Bed-Stuy is trying to help parents with the cost of child care by expanding the school day to 12 hours.

Residents in Southern Brooklyn are concerned over MTA's proposed changes as part of the Brooklyn Bus Network Redesign.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

Watch our special program, "Empire State Eclipse." CBS New York had a team of reporters spread across the state covering the rare total solar eclipse as the path of totality moved through the state.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance. You can feel lonely with friends or family, at your job, or in a crowd.

Long before we knew the names Uvalde, Pulse Nightclub, Parkland, and Sandy Hook, the nation was stunned and horrified by the Long Island Rail Road massacre.

David Schechter explores the connection between wildfires and climate change for "On The Dot."

Experts say climate change will continue to impact the Tri-State Area, driving bigger storm surges, more intense rainfall more often, and extreme heat that lingers longer, to name a few.

In 2021, 44% of high school students reported they persistently felt sad or hopeless, according to the Centers for Disease Control and Prevention. That's why CBS2 launched a series of special reports on breaking the stigma when it comes to children and mental health.

Superstorm Sandy was deadly, destructive and relentless. Ten years after Sandy, the hardest-hit areas are recovering and rebuilding.

CBS2 honors and celebrates the contributions of Black people to American history in our special.

From the top of a volcano in Hawaii to highways across the country, we'll help you understand where carbon dioxide in the atmosphere comes from and how it's warming our planet.

If you or someone you know needs help, you can call or text 988 to speak with a trained, caring counselor.

Your 20s are often referred to as the best time of your life, but for a lot of people, they can be a time of uncertainty at work in relationships and in regards to mental health. Dr. Meg Jay, an author and clinical psychologist, joins us to share her research.

Recent studies have found up to half of adolescents in the U.S. have engaged in self-harm at least once, often starting between the ages of 12 and 14. We're joined by psychologist Dr. Jennifer Hartstein, whose practice specializes in treating young people.

The technology gives users access to stress relief and relaxation techniques with practically the push of a button.

We hear from an expert who says boys often suffer in silence and shares advice for how parents can help.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance.

The forced isolation prompted increased feelings of despair and hopelessness. So how do we check in and support them four years later?

A recent study published in the journal JAMA Psychiatry suggests poor mental health may be a contributing factor.

The city filed a lawsuit against TikTok, Instagram, Facebook, Snapchat and YouTube.

Aaron Judge hit a two-run homer in the first inning after Oakland starting pitcher Joe Boyle was called for a balk on the previous pitch and the New York Yankees beat the Athletics 7-3.

Francisco Lindor hit a pair of two-run homers and the New York Mets avoided a three-game series sweep with an 8-2 win over the San Francisco Giants.

Logan Webb pitched eight strong innings and extended his scoreless streak to 19 as the San Francisco Giants beat the New York Mets 5-1 on Tuesday night.

Anthony Rizzo snapped a lengthy power drought with a two-run homer that capped a four-run first inning, and the New York Yankees held on for a 4-3 win over the Oakland Athletics.

Vincent Trocheck and Mika Zibanejad each had a goal and an assist and the Presidents' Trophy-winning New York Rangers held on to beat the Washington Capitals 4-3 for a 2-0 lead in their first-round playoff series.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

There's no safe time to look directly at the 2024 solar eclipse in the New York City area because it's outside the path of totality. Dr. Nidhi Kumar explains why you need special eclipse glasses to prevent permanent eye damage.

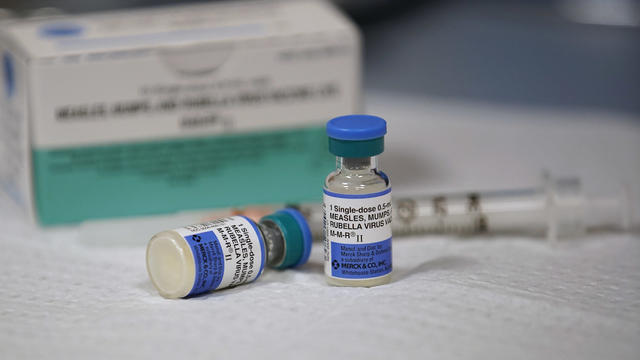

According to the CDC, cases of the highly infectious disease have already exceeded the total number of cases for all of 2023.

The CDC says roughly 25% of Americans suffer from season allergies, and studies suggest pollen season is getting longer and more intense.

Dr. Nidhi Kumar is On Call for CBS New York to break down the most common sleep disorders.

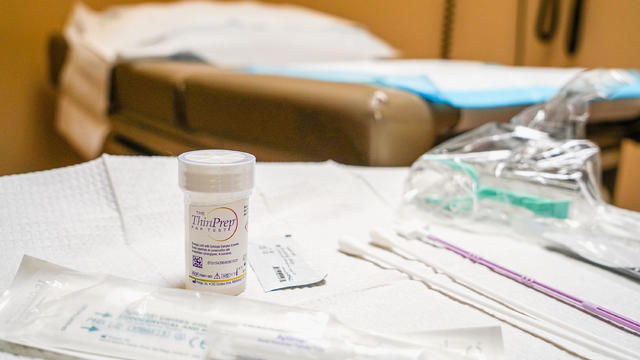

With expanded screening, treatment and vaccination, experts believe cervical cancer can be completely eliminated.

Maternal mortality continues to rise in the U.S., and a recent study suggests poor mental health may be a factor.

While very important, only 8% of patients attend the recommended 36 sessions of cardiac rehab.

Atrial fibrillation, or a-fib, is serious heart condition that causes abnormal heart rhythm.

More than 6 million Americans are living with dementia, and while there is no cure, patients can be helped by music.

Join CBS New York's Steve Overmyer in a tribute to winter in the Big Apple, when Christmas dreams and Hanukkah hopes brighten the skyline and warm our hearts even on the coldest nights.

Join us for a special Thanksgiving edition of stories of gratitude with CBS New York’s Steve Overmyer.

Get ready for a spine-chilling adventure as we delve into the world of the supernatural!

One man is making it his mission to give the heart of New York a heartbeat.

They discussed Pataki's book "Finding Margaret Fuller."

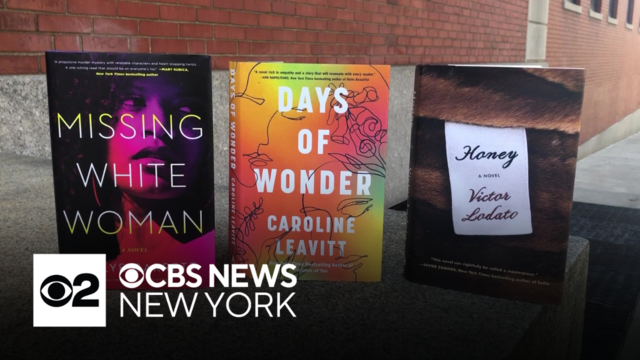

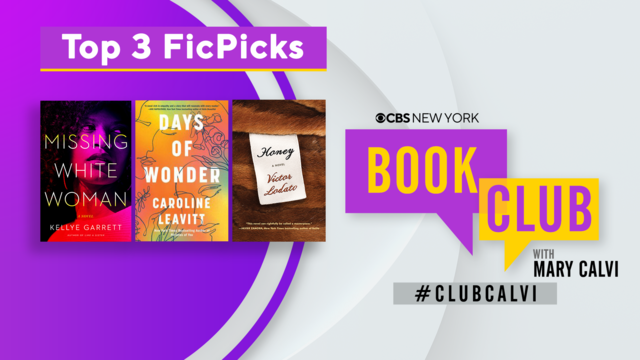

Will it be "Missing White Woman" by Kellye Garrett, "Days of Wonder" by Caroline Leavitt, or "Honey" by Victor Lodato?

It's time to vote on which book to read next: "Missing White Woman" by Kellye Garrett, "Days of Wonder" by Caroline Leavitt, or "Honey" by Victor Lodato.

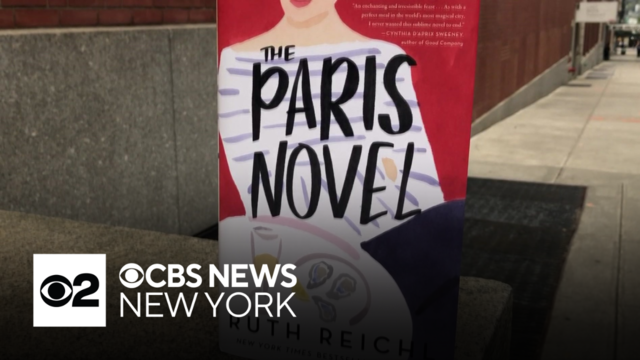

Our book club with Mary Calvi has a bonus read that is hitting shelves and sites next week. Hear from the author, Ruth Reichl.

The CBS New York Book Club is celebrating indie bookstores with the help of Bookshop.org.

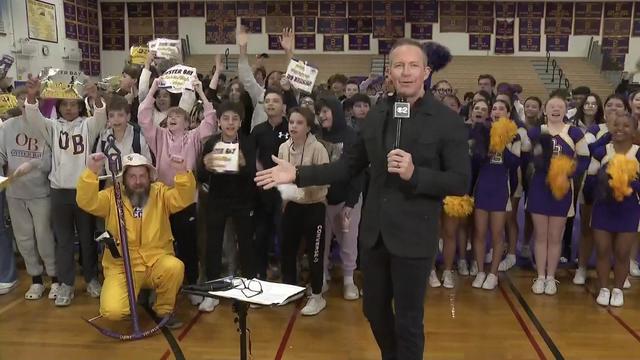

Meet freshman Luke Kugler and sophomore Gabriella Sherlock, who are dominating here at home and on the national level.

CBS New York's Chris Wragge spent the morning at the school that has everything from a fencing program to 3D printing.

Class Act with Chris Wragge heads to Long Island tomorrow for a live look at the school and its students.

CBS New York's Chris Wragge will be live from the high school this Friday morning.

CBS New York's Chris Wragge will be live at the Long Island high school this Friday morning.

This Friday, our morning show will be live from Oyster Bay High School in Nassau County.

CBS New York's Class Act with Chris Wragge is live this morning from the nearly-century-old school.

Arts High School of Newark has been around for nearly a century, and it's a school where dreams come true -- not for a few, but for many.

Be sure to join us Friday, when we'll be live all morning from Newark Arts High School.

For anyone living in New York City (or planning to move into Manhattan), and who's looking to save money by bundling their TV and home Internet service, here are the best options.

Need internet at your new home ASAP? Here's how to set up a simple, painless transfer that'll have you online in no time.

Before you make the big move to the Big Apple, make sure your new home internet is the fastest, and offers the best value.

As the Columbia protests continue, New York City Mayor Eric Adams says there's no need to call in the National Guard.

Former President Donald Trump visited a construction site in Midtown for an NYC rally before returning to court in his alleged "hush money" trial.

Two NYPD officers are accused of sexually assaulting a woman while they were off-duty in 2023.

The family of the man who was killed when a New York City parking garage collapsed in 2023 has filed a lawsuit against the building's owners.

Gov. Hochul secures funding for New Yorkers struggling with mental illness and involved in the criminal justice system.

Former MIT researcher Qinxuan Pan has been sentenced to 35 years in prison in the 2021 murder of Yale graduate student Kevin Jiang.

Two heroic men saved a little girl that was running into into a busy intersection in East Hartford, Connecticut.

Expect to see a passing shower this afternoon, with a rumble here and there. Temperatures will be in the upper 60s to around 70 degrees.

U.S. News & World Report on Tuesday released their 2024 high school rankings, including nearly 2,000 in New York, New Jersey and Connecticut combined.

We're about to get into the heart of severe weather season in the Tri-State Area, so what can you do to prepare your home and property?

A New Jersey woman has received a first-of-its-kind transplant using a modified pig kidney along with a heart pump.

The city of Passaic, New Jersey is receiving over $1.5 million in federal funds for flash flood remediation.

Expect to see a passing shower this afternoon, with a rumble here and there. Temperatures will be in the upper 60s to around 70 degrees.

U.S. News & World Report on Tuesday released their 2024 high school rankings, including nearly 2,000 in New York, New Jersey and Connecticut combined.

We're about to get into the heart of severe weather season in the Tri-State Area, so what can you do to prepare your home and property?

Gov. Hochul secures funding for New Yorkers struggling with mental illness and involved in the criminal justice system.

Authorities with several law enforcement agencies searched an area in Manorville Wednesday for evidence in the Gilgo Beach murders case.

U.S. News & World Report on Tuesday released their 2024 high school rankings, including nearly 2,000 in New York, New Jersey and Connecticut combined.

Many romance scam support groups are full of people making other questionable promises of recovering funds, the CBS New York Investigative Team found.

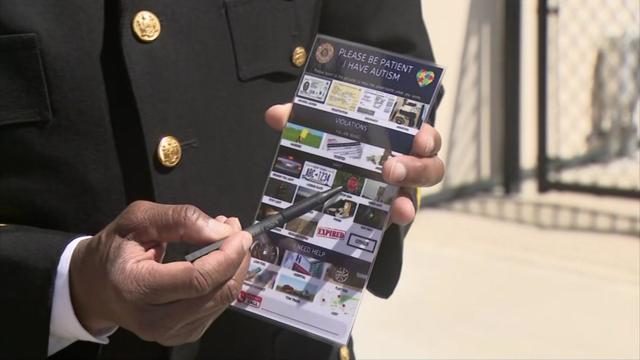

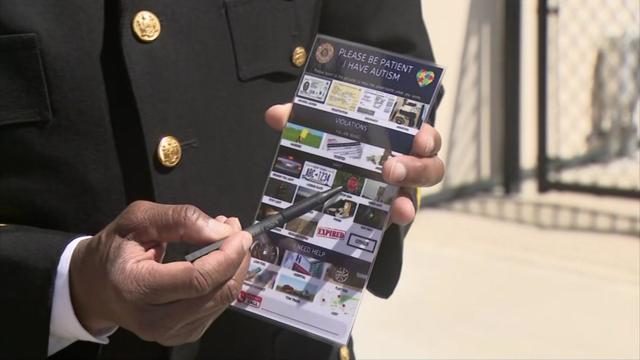

Suffolk County law enforcement officers are now equipped with a tool to help people on the autism spectrum during stressful encounters.

Follow live updates of Donald Trump's New York criminal trial, where former National Enquirer boss David Pecker is testifying for the third day.

Former President Donald Trump visited a construction site in Midtown for an NYC rally before returning to court in his alleged "hush money" trial.

Gov. Hochul secures funding for New Yorkers struggling with mental illness and involved in the criminal justice system.

Mayor Eric Adams announced New York City's executive budget for the next fiscal year on Wednesday.

House Speaker Mike Johnson was met with loud boos as he visited Columbia University, where he joined calls for the president's resignation amid pro-Palestinian protests.

A New Jersey woman has received a first-of-its-kind transplant using a modified pig kidney along with a heart pump.

Suffolk County law enforcement officers are now equipped with a tool to help people on the autism spectrum during stressful encounters.

High blood pressure, or hypertension, may increase the risk of dementia, according to a new study. Hear from a doctor for advice on lowering your risk factors.

A New York City company promoted "$0 cost" COVID tests, then got over 100 complaints after people were told they may owe hundreds.

On the eve of 4/20, Gov. Kathy Hochul unveiled a plan for law enforcement to lock up thousands of illegal marijuana shops.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

The classic musical, which first opened in 1966, is back on Broadway in an immersive new production titled "Cabaret at the Kit Kat Club," starring Eddie Redmayne, Gayle Rankin and Bebe Neuwirth. Leave your troubles outside!

Taylor Swift's new album, "The Tortured Poets Department," was released Friday, and Swifties in New York City came together to celebrate.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

The singers first dated in 2003 and delighted fans when they rekindled their relationship in 2023.

Aaron Judge hit a two-run homer in the first inning after Oakland starting pitcher Joe Boyle was called for a balk on the previous pitch and the New York Yankees beat the Athletics 7-3.

Francisco Lindor hit a pair of two-run homers and the New York Mets avoided a three-game series sweep with an 8-2 win over the San Francisco Giants.

Logan Webb pitched eight strong innings and extended his scoreless streak to 19 as the San Francisco Giants beat the New York Mets 5-1 on Tuesday night.

Anthony Rizzo snapped a lengthy power drought with a two-run homer that capped a four-run first inning, and the New York Yankees held on for a 4-3 win over the Oakland Athletics.

Vincent Trocheck and Mika Zibanejad each had a goal and an assist and the Presidents' Trophy-winning New York Rangers held on to beat the Washington Capitals 4-3 for a 2-0 lead in their first-round playoff series.

Some Queens residents are fuming over cars parking on beloved greenway.

The 12th Annual Black Comic Book Festival returns to the Schomburg Center later this week.

There are plans to turn an Inwood parking lot into new affordable apartments for the community.

From affordable housing to commercial properties, New York City developers are addressing the climate crisis in a variety of ways.

A New York City organization is taking action to clean up drug needles and syringes littering a South Bronx park.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The 50th Annual Village Halloween Parade drew massive crowds, celebrating the theme "Upside/Down:Inside/OUT."

As much of the northeast experiences heavy rains, parts of New York City are beginning to flood.

Thousands of people flooded Union Square on Friday for a PlayStation giveaway promoted by livestreamer Kai Cenat.

A crane went up in flames high above Manhattan, then partially collapsed onto the street below.

CBS New York hears from New York City Mayor Eric Adams about the law enforcement response to the pro-Palestinian protests at Columbia University, NYU and beyond.

Former President Donald Trump visited a construction site in New York City early Thursday morning, before returning to court for his alleged "hush money" trial. CBS New York's Natalie Duddridge was there for what he had to say.

The school has given students a Friday deadline to clear their pro-Palestinian encampment from the main lawn. CBS New York's Christina Fan reports on the negotiations.

The former president will be in a Manhattan courtroom for witness testimony in his "hush money" trial, as the Supreme Court hears his presidential immunity case. CBS New York's Elijah Westbrook has the latest.

CBS New York's First Alert Weather Team has the latest forecast.