CBS News Live

CBS News New York: Local News, Weather & More

Watch CBS News

The intensity at Columbia University has been building for hours after police started making arrests and removing protesters from encampments.

Twelve people have been selected to serve as jurors in former President Donald Trump's criminal trial in New York, filling out the panel on the third day of proceedings.

A suspect is on the loose after a 19-year-old man was fatally stabbed during a parking dispute outside his family's apartment building in the Bronx.

One public library in New Jersey is offering free gently used wedding dresses for brides-to-be. The selection is getting bigger by the day, thanks to donations coming in.

A young Long Island boy is the first in New York state to undergo a new gene therapy for a rare blood disease.

The conservative Christian group has controlled Ocean Grove's beaches for more than 150 years.

Illegal pot shops are popping up near New York City schools and daycares and there needs to be a crackdown, community group Silent Voices United says.

Officials say a 5-foot rat snake has taken up residence in Congers Lake in Clarkstown.

Montefiore in the Bronx screened 200,000 people for social detriments of health, and found at least 20% have at least one social need.

A special ceremony was held Thursday at the site of a synagogue that burned to the ground in Pomona, Rockland County. Members of the Orthodox Jewish community gathered as a eulogy was read for three Torahs destroyed in the fire at Chassidim of the Heights. A burial for the Torahs will be held in May.

Two squatters accused of killing a woman inside her mother's New York City apartment, then leaving her body in a duffel bag faced separate judges Thursday. Halley Tejada, 19, and his girlfriend pleaded not guilty to second-degree murder.

A gene was actually added to 8-year-old Yusef Saeed's blood cells to cure a life-threatening ailment. CBS New York's Carolyn Gusoff reports.

Conservative Christian group Ocean Group Camp Meeting Association has controlled Ocean Grove's beaches for more than 150 years. CBS New York's Christine Sloan reports.

One year ago Thursday, a parking garage crumbled to the ground in Lower Manhattan, killing a man who worked there. Since then, there have been questions about the safety of other buildings citywide and calls for more inspections. CBS New York investigative reporter Mahsa Saeidi is working to find out if that's actually happened.

A great investigative news tip should explain the situation in detail, be newsworthy, and have real-world consequences.

One person was killed and five others were injured in the parking garage collapse on Ann Street in the Financial District on April 18, 2023.

Three New York companies say their bills are being ignored after lighting up Citi Field for the Amaze Light Festival.

A new report from the NYPD's court-appointed monitor says the department still has plenty of work to do to address racial disparities in policing.

Local researchers are studying what a similar impact would mean for area bridges and shared their findings with CBS New York.

The deadly shooting of a mentally distressed Queens man who called 911 for help is putting a renewed focus on mental health emergencies.

But CBS New York investigative reporter Tim McNicholas has learned the plan already had some vocal critics.

More than 200 New Jersey police officers went through three hours of retraining in Trenton after they attended a controversial conference in Atlantic City in 2021.

Eight arrests were made and authorities hope it sends a message to those trying to evade tolls or cause mayhem.

The Red Bank Police Department bid farewell to two beloved veteran K-9 officers, who are retiring.

With the Final Four upon us, we're taking a look back on a team that took New York City by storm.

New York City's congestion pricing toll now has final approval from the MTA. See the map and what you need to know.

Residents in Southern Brooklyn are concerned over MTA's proposed changes as part of the Brooklyn Bus Network Redesign.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

President Joe Biden dropped in virtually to speak at the National Action Network convention Friday, breaking down his efforts to reduce the burden on Black people and boost opportunities for their success.

From eating cash to long lines, subway riders in Queens say their MetroCard machines are a mess.

There are mounting concerns over the future of some Catholic schools in New York City after historic Visitation Academy, an all-girls school in Brooklyn, announced it is shutting down.

The Parks Department said it's removed more than 6,000 syringes from St. Mary's Park in the South Bronx so far in 2024.

The Golden Mall food court, known for Asian flavors, has reopened in Queens after a major redesign.

Watch our special program, "Empire State Eclipse." CBS New York had a team of reporters spread across the state covering the rare total solar eclipse as the path of totality moved through the state.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance. You can feel lonely with friends or family, at your job, or in a crowd.

Long before we knew the names Uvalde, Pulse Nightclub, Parkland, and Sandy Hook, the nation was stunned and horrified by the Long Island Rail Road massacre.

David Schechter explores the connection between wildfires and climate change for "On The Dot."

Experts say climate change will continue to impact the Tri-State Area, driving bigger storm surges, more intense rainfall more often, and extreme heat that lingers longer, to name a few.

In 2021, 44% of high school students reported they persistently felt sad or hopeless, according to the Centers for Disease Control and Prevention. That's why CBS2 launched a series of special reports on breaking the stigma when it comes to children and mental health.

Superstorm Sandy was deadly, destructive and relentless. Ten years after Sandy, the hardest-hit areas are recovering and rebuilding.

CBS2 honors and celebrates the contributions of Black people to American history in our special.

From the top of a volcano in Hawaii to highways across the country, we'll help you understand where carbon dioxide in the atmosphere comes from and how it's warming our planet.

If you or someone you know needs help, you can call or text 988 to speak with a trained, caring counselor.

Your 20s are often referred to as the best time of your life, but for a lot of people, they can be a time of uncertainty at work in relationships and in regards to mental health. Dr. Meg Jay, an author and clinical psychologist, joins us to share her research.

Recent studies have found up to half of adolescents in the U.S. have engaged in self-harm at least once, often starting between the ages of 12 and 14. We're joined by psychologist Dr. Jennifer Hartstein, whose practice specializes in treating young people.

The technology gives users access to stress relief and relaxation techniques with practically the push of a button.

We hear from an expert who says boys often suffer in silence and shares advice for how parents can help.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance.

The forced isolation prompted increased feelings of despair and hopelessness. So how do we check in and support them four years later?

A recent study published in the journal JAMA Psychiatry suggests poor mental health may be a contributing factor.

The city filed a lawsuit against TikTok, Instagram, Facebook, Snapchat and YouTube.

Simon Holmstrom scored the go-ahead goal in the third period, Ilya Sorokin stopped Sidney Crosby on a late penalty shot and the playoff-bound New York Islanders edged the Pittsburgh Penguins 5-4.

Aaron Judge broke a 4-all tie with a two-run single in the ninth inning, Juan Soto and Giancarlo Stanton hit solo home runs and the New York Yankees rallied to beat the Toronto Blue Jays 6-4 to avoid their first sweep of the season.

Starling Marte hit his 150th career homer, powering the New York Mets to a 9-1 win over the Pittsburgh Pirates and a sweep of a three-game series.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

There's no safe time to look directly at the 2024 solar eclipse in the New York City area because it's outside the path of totality. Dr. Nidhi Kumar explains why you need special eclipse glasses to prevent permanent eye damage.

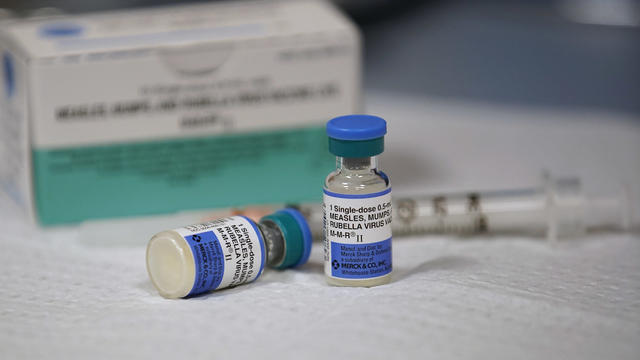

According to the CDC, cases of the highly infectious disease have already exceeded the total number of cases for all of 2023.

The CDC says roughly 25% of Americans suffer from season allergies, and studies suggest pollen season is getting longer and more intense.

Dr. Nidhi Kumar is On Call for CBS New York to break down the most common sleep disorders.

With expanded screening, treatment and vaccination, experts believe cervical cancer can be completely eliminated.

Maternal mortality continues to rise in the U.S., and a recent study suggests poor mental health may be a factor.

While very important, only 8% of patients attend the recommended 36 sessions of cardiac rehab.

Atrial fibrillation, or a-fib, is serious heart condition that causes abnormal heart rhythm.

More than 6 million Americans are living with dementia, and while there is no cure, patients can be helped by music.

Join CBS New York's Steve Overmyer in a tribute to winter in the Big Apple, when Christmas dreams and Hanukkah hopes brighten the skyline and warm our hearts even on the coldest nights.

Join us for a special Thanksgiving edition of stories of gratitude with CBS New York’s Steve Overmyer.

Get ready for a spine-chilling adventure as we delve into the world of the supernatural!

One man is making it his mission to give the heart of New York a heartbeat.

The CBS New York Book Club is celebrating indie bookstores with the help of Bookshop.org.

"Finding Margaret Fuller" has been chosen as our next read for the CBS New York Book Club with Mary Calvi.

After thousands of votes were cast for the CBS New York Book Club's Top 3 FicPicks, "Finding Margaret Fuller" is the next read.

After thousands of votes were cast for the CBS New York Book Club's Top 3 FicPicks, "Finding Margaret Fuller" is the next read.

They discussed Cheeks' book "Acts of Forgiveness."

Meet freshman Luke Kugler and sophomore Gabriella Sherlock, who are dominating here at home and on the national level.

CBS New York's Chris Wragge spent the morning at the school that has everything from a fencing program to 3D printing.

Class Act with Chris Wragge heads to Long Island tomorrow for a live look at the school and its students.

CBS New York's Chris Wragge will be live from the high school this Friday morning.

CBS New York's Chris Wragge will be live at the Long Island high school this Friday morning.

This Friday, our morning show will be live from Oyster Bay High School in Nassau County.

CBS New York's Class Act with Chris Wragge is live this morning from the nearly-century-old school.

Arts High School of Newark has been around for nearly a century, and it's a school where dreams come true -- not for a few, but for many.

Be sure to join us Friday, when we'll be live all morning from Newark Arts High School.

Need internet at your new home ASAP? Here's how to set up a simple, painless transfer that'll have you online in no time.

Before you make the big move to the Big Apple, make sure your new home internet is the fastest, and offers the best value.

Want to keep your internet when you move? You may be able to transfer service instead of canceling outright.

A young Long Island boy is the first in New York state to undergo a new gene therapy for a rare blood disease.

Illegal pot shops are popping up near New York City schools and daycares and there needs to be a crackdown, community group Silent Voices United says.

Montefiore in the Bronx screened 200,000 people for social detriments of health, and found at least 20% have at least one social need.

The attorney for a man accused of killing a 19-year-old woman in a Brooklyn deli and stabbing her twin sister says his client was acting in self-defense.

One person was killed and five others were injured in the parking garage collapse on Ann Street in the Financial District on April 18, 2023.

Some lingering rain and light drizzle remains Thursday, and temperatures will be about 10 degrees cooler, feeling like the 40s.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

We're in for another sunny and pleasantly warm afternoon, but not as warm as yesterday. Highs will be in the low 70s.

Today will be sunny with highs in the mid to upper 70s, possibly even 80 inland. Late showers are possible south of the city.

Damaging wind gusts are the main threat, but we can't rule out small hail or an isolated tornado northwest of NYC.

One public library in New Jersey is offering free gently used wedding dresses for brides-to-be. The selection is getting bigger by the day, thanks to donations coming in.

The conservative Christian group has controlled Ocean Grove's beaches for more than 150 years.

Some lingering rain and light drizzle remains Thursday, and temperatures will be about 10 degrees cooler, feeling like the 40s.

A New Jersey father accused of killing his 9-year-old son back on March 28 has died from injuries he suffered that same day, officials said.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

A young Long Island boy is the first in New York state to undergo a new gene therapy for a rare blood disease.

Over 250 pizzerias across Long Island are raising money Wednesday for three police charities and the family of fallen NYPD Det. Jonathan Diller.

Suspected Gilgo Beach serial killer Rex Heuermann is appeared in court in Suffolk County, Long Island.

More 55-gallon drums containing waste petroleum and chlorinated solvents have been found buried in Bethpage Community Park.

Lindy Jones pleads not guilty in last month's deadly shooting of NYPD Det. Jonathan Diller in Far Rockaway, Queens.

Rep. Ilhan Omar's daughter says she was one of three students suspended from Barnard College following a pro-Palestinian protest at Columbia University on Thursday.

Police arrested more than 100 people at Columbia University on Thursday at a makeshift encampment set up by pro-Palestinian protesters on the university's main lawn.

Twelve people have been selected to serve as jurors in former President Donald Trump's criminal trial in New York, filling out the panel on the third day of proceedings.

CBS New York did some digging and found out just how much the MTA has budgeted for congestion pricing pollution mitigation.

Under the 5th Amendment, the jury is prohibited from holding it against former President Donald Trump if he does not testify.

Montefiore in the Bronx screened 200,000 people for social detriments of health, and found at least 20% have at least one social need.

19 people have been stricken — including nine who have been hospitalized — after getting fake or mishandled injections in homes and spas, feds warn.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

The coming-of-age story is a favorite for generations of middle and high school students, and they're returning to it on Broadway.

CBS New York's Steve Overmyer met Ed Alstrom, the organ player who has been hyping up Yankees fans in the Bronx for over 20 seasons.

Eleanor documented much of the chaos on "Apocalypse Now" in what would become one of the most famous making-of films about moviemaking, 1991's "Hearts of Darkness: A Filmmaker's Apocalypse."

Simon Holmstrom scored the go-ahead goal in the third period, Ilya Sorokin stopped Sidney Crosby on a late penalty shot and the playoff-bound New York Islanders edged the Pittsburgh Penguins 5-4.

Aaron Judge broke a 4-all tie with a two-run single in the ninth inning, Juan Soto and Giancarlo Stanton hit solo home runs and the New York Yankees rallied to beat the Toronto Blue Jays 6-4 to avoid their first sweep of the season.

Starling Marte hit his 150th career homer, powering the New York Mets to a 9-1 win over the Pittsburgh Pirates and a sweep of a three-game series.

The No. 1 pick in this year's WNBA draft is "going to raise all boats" for players in the league, one expert said.

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Residents in Southern Brooklyn are concerned over MTA's proposed changes as part of the Brooklyn Bus Network Redesign.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

President Joe Biden dropped in virtually to speak at the National Action Network convention Friday, breaking down his efforts to reduce the burden on Black people and boost opportunities for their success.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The 50th Annual Village Halloween Parade drew massive crowds, celebrating the theme "Upside/Down:Inside/OUT."

As much of the northeast experiences heavy rains, parts of New York City are beginning to flood.

Thousands of people flooded Union Square on Friday for a PlayStation giveaway promoted by livestreamer Kai Cenat.

A crane went up in flames high above Manhattan, then partially collapsed onto the street below.

A special ceremony was held Thursday at the site of a synagogue that burned to the ground in Pomona, Rockland County. Members of the Orthodox Jewish community gathered as a eulogy was read for three Torahs destroyed in the fire at Chassidim of the Heights. A burial for the Torahs will be held in May.

Two squatters accused of killing a woman inside her mother's New York City apartment, then leaving her body in a duffel bag faced separate judges Thursday. Halley Tejada, 19, and his girlfriend pleaded not guilty to second-degree murder.

A gene was actually added to 8-year-old Yusef Saeed's blood cells to cure a life-threatening ailment. CBS New York's Carolyn Gusoff reports.

Conservative Christian group Ocean Group Camp Meeting Association has controlled Ocean Grove's beaches for more than 150 years. CBS New York's Christine Sloan reports.

One year ago Thursday, a parking garage crumbled to the ground in Lower Manhattan, killing a man who worked there. Since then, there have been questions about the safety of other buildings citywide and calls for more inspections. CBS New York investigative reporter Mahsa Saeidi is working to find out if that's actually happened.