House approves Child Tax Credit expansion. Here's who could benefit.

The Child Tax Credit is one step closer to getting a major expansion, potentially putting more money in parents' pockets.

Watch CBS News

The Child Tax Credit is one step closer to getting a major expansion, potentially putting more money in parents' pockets.

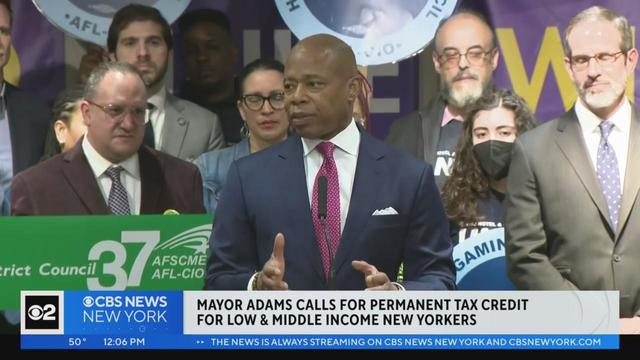

The mayor is calling on state lawmakers to make a tax credit that helps low and middle income families.

Some Americans, especially those who don't pay taxes, may still be due some pandemic money, a government report says.

Gov. Ned Lamont will hold a press conference Tuesday ahead of the deadline this weekend.

Families can start applying on June 1.

The fifth round of advance Child Tax Credit payments went out Monday morning, and parents are already seeing the extra money in their bank accounts.

The next advance Child Tax Credit payment goes out next Monday, with direct deposits arriving almost immediately and mailed checks taking a little longer.

The third round of advance Child Tax Credit payments went out Friday morning, and parents are already seeing the extra money in their bank accounts.

The next advance Child Tax Credit payment goes out Friday, with direct deposits arriving almost immediately and mailed checks taking a little longer.

The next Child Tax Credit payment is due October 15, but some parents may prefer a lump-sum payment at tax time.

The Internal Revenue Service (IRS) sent out the third round advance Child Tax Credit payments on September 15. What time the check arrives depends on the payment method and individual banks.

The next advance Child Tax Credit payment will be sent out this week, with direct deposits arriving almost immediately and mailed checks taking a little longer.

This is how the updated Child Tax Credit works, along with a few reasons why payments could be delayed, inaccurate, or come in a different form.

The IRS sent out the second round of Child Tax Credit payments Friday morning, and deposits are already showing up in parents' bank accounts.

The advance Child Tax Credit pays parents up to $300 per month per child to help with the cost of raising them.

The next advance Child Tax Credit payment will be sent out this week, and should arrive a couple days earlier than it did last month.

The next round of Child Tax Credit payments are due August 13, but some parents may prefer a lump-sum payment at tax time.

Advance payments for the updated Child Tax Credit will start to arrive again on August 13. These IRS tools will help you manage your money.

In some cases, the scammers say they could expedite the monthly payments and instead give a lump sum.

While the next Child Tax Credit payment is due August 13, the deadline to opt out of advance payments is August 2. Here's how to do it.

The first round of advance Child Tax Credit payments went out to parents on July 15, but some payments have been delayed or were inaccurate.

The IRS sent out the first round of advance Child Tax Credit payments on July 15, and the money is already reaching parents.

In order for families to qualify, single taxpayers must make $75,000 or less, and married couples filing taxes jointly must make $150,000 or less.

The IRS will soon begin sending advance Child Tax Credit payments, but the arrival date may depend on how your last stimulus check or tax refund arrived.

With the revised Child Tax Credit due to start shortly, these IRS tools help parents to check eligibility and ensure they receive what they're owed.

Salvatore Rubino kicked illegal gambling profits to the Genovese crime family, prosecutors say.

Suspected Gilgo Beach serial killer Rex Heuermann is scheduled to appear in court in Suffolk County, Long Island.

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Jose Hernandez balked home the go-ahead run in the seventh inning, Jeff McNeil added an RBI double and the New York Mets beat the Pittsburgh Pirates 3-1.

A 13-year-old girl from Brooklyn has been charged with criminal possession of a weapon after she allegedly accidentally shot her 11-year-old brother, police sources tell CBS New York.

A 13-year-old girl from Brooklyn has been charged with criminal possession of a weapon after she allegedly accidentally shot her 11-year-old brother, police sources tell CBS New York.

Police say one man was killed and three were injured when gunmen on scooters opened fire in the Bronx on Tuesday.

Resolutions introduced to the New York City Council propose ways to crack down on helicopter noise across the city.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

New York City health officials are warning of a worrisome increase in the number of leptospirosis cases from contact with rat urine.

We're in for another sunny and pleasantly warm afternoon, but not as warm as yesterday. Highs will be in the low 70s.

Today will be sunny with highs in the mid to upper 70s, possibly even 80 inland. Late showers are possible south of the city.

Damaging wind gusts are the main threat, but we can't rule out small hail or an isolated tornado northwest of NYC.

Thousands lined the streets of downtown Hartford on Saturday to celebrate UConn's second straight NCAA men's basketball championship, and sixth in 25 years.

Highs will be in the low to mid 50s, but a blustery wind gusting 30+ mph will make it feel more like a late winter day.

Emergency crews worked all night to clear debris from tractor trailer crash above Elizabeth Avenue.

We're in for another sunny and pleasantly warm afternoon, but not as warm as yesterday. Highs will be in the low 70s.

Crews are working to reopen the roadway after part of a retaining wall collapsed onto the New Jersey Turnpike.

The statue of A. Philip Randolph in Newark is one of only three of the civil rights icon in the U.S.

For 36 years, John Sterling was the voice of the Yankees. His retirement will be recognized in a pregame ceremony on Saturday.

Suspected Gilgo Beach serial killer Rex Heuermann is scheduled to appear in court in Suffolk County, Long Island.

More 55-gallon drums containing waste petroleum and chlorinated solvents have been found buried in Bethpage Community Park.

Lindy Jones pleads not guilty in last month's deadly shooting of NYPD Det. Jonathan Diller in Far Rockaway, Queens.

Many New Yorkers fear more fallout from escalating tensions between Israel and Iran. For now, there's extra police outside Jewish institutions as all pray for a peaceful future.

Jake's 58 expansion is expected to double betting terminals to 2,000 and more than triple the number of parking spaces.

Sen. Bob Menendez heads to trial next month to fight charges that he traded his political influence for cash, gold bars and a luxury car.

New York City health officials are warning of a worrisome increase in the number of leptospirosis cases from contact with rat urine.

Seven Manhattan residents were selected Tuesday afternoon to serve on the jury in former President Donald Trump's criminal trial.

The operation against illegal street vendors in Jackson Heights on Monday was part of New York City's attempt to address quality-of-life issues

The Donald Trump "hush money" trial will cause headaches for people who live, work and visit Lower Manhattan.

19 people have been stricken — including nine who have been hospitalized — after getting fake or mishandled injections in homes and spas, feds warn.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

Black women are three times more likely to die from a pregnancy-related cause than white women, according to the CDC.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

The coming-of-age story is a favorite for generations of middle and high school students, and they're returning to it on Broadway.

CBS New York's Steve Overmyer met Ed Alstrom, the organ player who has been hyping up Yankees fans in the Bronx for over 20 seasons.

Eleanor documented much of the chaos on "Apocalypse Now" in what would become one of the most famous making-of films about moviemaking, 1991's "Hearts of Darkness: A Filmmaker's Apocalypse."

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Jose Hernandez balked home the go-ahead run in the seventh inning, Jeff McNeil added an RBI double and the New York Mets beat the Pittsburgh Pirates 3-1.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

Knicks superfan Anthony Donahue says he expects to travel with the team as long as they are alive in the NBA playoffs.

How far the Rangers go in the postseason will almost certainly depend on Artemi Panarin continuing his brilliance.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

President Joe Biden dropped in virtually to speak at the National Action Network convention Friday, breaking down his efforts to reduce the burden on Black people and boost opportunities for their success.

From eating cash to long lines, subway riders in Queens say their MetroCard machines are a mess.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The 50th Annual Village Halloween Parade drew massive crowds, celebrating the theme "Upside/Down:Inside/OUT."

As much of the northeast experiences heavy rains, parts of New York City are beginning to flood.

Thousands of people flooded Union Square on Friday for a PlayStation giveaway promoted by livestreamer Kai Cenat.

A crane went up in flames high above Manhattan, then partially collapsed onto the street below.

Craig Ross pleaded guilty in February to kidnapping and sexually abusing the girl after she went for a bike ride at Moreau State Park in Saratoga County.

Firefighters are on the scene of the early-morning fire in Pomona, New York.

Chopper 2 was overhead in Haledon, New Jersey where it appears a tree fell onto a home.

CBS New York's First Alert Weather team has the latest forecast.

The hearing comes after students protested the Oct. 7 attack in Israel and the war on Gaza.