CBS News Live

CBS News New York: Local News, Weather & More

Watch CBS News

Police say one man was killed and three were injured when gunmen on scooters opened fire in the Bronx on Tuesday.

Former President Donald Trump met with bodega workers in Manhattan after his second day in court Tuesday.

Columbia University President Dr. Minouche Shafik is testifying about antisemitism on college campuses before the House Committee on Education and the Workforce.

Due to budget cuts and growing class sizes, some New York City parents have chosen to take their children out of public schools, to give their kids a more individualized education.

Seven Manhattan residents were selected Tuesday afternoon to serve on the jury in former President Donald Trump's criminal trial.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

Hundreds of Black migrants, many from African countries, showed up at City Hall Tuesday demanding better treatment.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

It was a brief appearance at Suffolk County Supreme Court in Riverhead. Heuermann wore a suit and tie and had his hands cuffed behind his back. His estranged wife was also there. CBS New York's Mary Calvi reports.

Columbia University President Dr. Minouche Shafik is testifying before Congress, as part of ongoing hearings about antisemitism on school campuses. CBS New York's Jessica Moore reports from the newsroom.

CBS New York's Tony Aiello has more on the investigation in Pomona, N.Y.

From libraries to schools, almost every public service in New York City has seen significant budget cuts this year. So what do those cuts look like for early childhood education.

Nearly 200,000 men and women leave the military every year, and some need help reacclimating. Now two veteran organizations are teaming up to help those who served stay ahead of potentially serious problems.

A great investigative news tip should explain the situation in detail, be newsworthy, and have real-world consequences.

Three New York companies say their bills are being ignored after lighting up Citi Field for the Amaze Light Festival.

A new report from the NYPD's court-appointed monitor says the department still has plenty of work to do to address racial disparities in policing.

Local researchers are studying what a similar impact would mean for area bridges and shared their findings with CBS New York.

The deadly shooting of a mentally distressed Queens man who called 911 for help is putting a renewed focus on mental health emergencies.

But CBS New York investigative reporter Tim McNicholas has learned the plan already had some vocal critics.

More than 200 New Jersey police officers went through three hours of retraining in Trenton after they attended a controversial conference in Atlantic City in 2021.

Eight arrests were made and authorities hope it sends a message to those trying to evade tolls or cause mayhem.

Data analyzed by CBS New York Investigates shows many of the most-traveled stations are also where the most felony assaults happen.

The Red Bank Police Department bid farewell to two beloved veteran K-9 officers, who are retiring.

With the Final Four upon us, we're taking a look back on a team that took New York City by storm.

New York City's congestion pricing toll now has final approval from the MTA. See the map and what you need to know.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

President Joe Biden dropped in virtually to speak at the National Action Network convention Friday, breaking down his efforts to reduce the burden on Black people and boost opportunities for their success.

From eating cash to long lines, subway riders in Queens say their MetroCard machines are a mess.

There are mounting concerns over the future of some Catholic schools in New York City after historic Visitation Academy, an all-girls school in Brooklyn, announced it is shutting down.

The Parks Department said it's removed more than 6,000 syringes from St. Mary's Park in the South Bronx so far in 2024.

The Golden Mall food court, known for Asian flavors, has reopened in Queens after a major redesign.

It is the now the first CUNY school to have an accredited infant toddler program for children as young as six weeks old.

Watch our special program, "Empire State Eclipse." CBS New York had a team of reporters spread across the state covering the rare total solar eclipse as the path of totality moved through the state.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance. You can feel lonely with friends or family, at your job, or in a crowd.

Long before we knew the names Uvalde, Pulse Nightclub, Parkland, and Sandy Hook, the nation was stunned and horrified by the Long Island Rail Road massacre.

David Schechter explores the connection between wildfires and climate change for "On The Dot."

Experts say climate change will continue to impact the Tri-State Area, driving bigger storm surges, more intense rainfall more often, and extreme heat that lingers longer, to name a few.

In 2021, 44% of high school students reported they persistently felt sad or hopeless, according to the Centers for Disease Control and Prevention. That's why CBS2 launched a series of special reports on breaking the stigma when it comes to children and mental health.

Superstorm Sandy was deadly, destructive and relentless. Ten years after Sandy, the hardest-hit areas are recovering and rebuilding.

CBS2 honors and celebrates the contributions of Black people to American history in our special.

From the top of a volcano in Hawaii to highways across the country, we'll help you understand where carbon dioxide in the atmosphere comes from and how it's warming our planet.

If you or someone you know needs help, you can call or text 988 to speak with a trained, caring counselor.

Your 20s are often referred to as the best time of your life, but for a lot of people, they can be a time of uncertainty at work in relationships and in regards to mental health. Dr. Meg Jay, an author and clinical psychologist, joins us to share her research.

Recent studies have found up to half of adolescents in the U.S. have engaged in self-harm at least once, often starting between the ages of 12 and 14. We're joined by psychologist Dr. Jennifer Hartstein, whose practice specializes in treating young people.

The technology gives users access to stress relief and relaxation techniques with practically the push of a button.

We hear from an expert who says boys often suffer in silence and shares advice for how parents can help.

Many people want to understand how to overcome loneliness. Loneliness can impact just about anyone of any age and any circumstance.

The forced isolation prompted increased feelings of despair and hopelessness. So how do we check in and support them four years later?

A recent study published in the journal JAMA Psychiatry suggests poor mental health may be a contributing factor.

The city filed a lawsuit against TikTok, Instagram, Facebook, Snapchat and YouTube.

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Jose Hernandez balked home the go-ahead run in the seventh inning, Jeff McNeil added an RBI double and the New York Mets beat the Pittsburgh Pirates 3-1.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

Knicks superfan Anthony Donahue says he expects to travel with the team as long as they are alive in the NBA playoffs.

How far the Rangers go in the postseason will almost certainly depend on Artemi Panarin continuing his brilliance.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

There's no safe time to look directly at the 2024 solar eclipse in the New York City area because it's outside the path of totality. Dr. Nidhi Kumar explains why you need special eclipse glasses to prevent permanent eye damage.

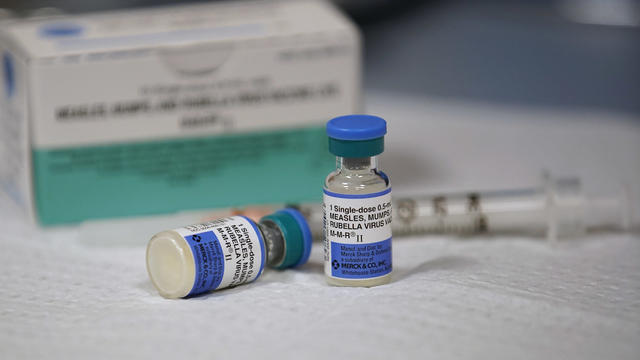

According to the CDC, cases of the highly infectious disease have already exceeded the total number of cases for all of 2023.

The CDC says roughly 25% of Americans suffer from season allergies, and studies suggest pollen season is getting longer and more intense.

Dr. Nidhi Kumar is On Call for CBS New York to break down the most common sleep disorders.

With expanded screening, treatment and vaccination, experts believe cervical cancer can be completely eliminated.

Maternal mortality continues to rise in the U.S., and a recent study suggests poor mental health may be a factor.

While very important, only 8% of patients attend the recommended 36 sessions of cardiac rehab.

Atrial fibrillation, or a-fib, is serious heart condition that causes abnormal heart rhythm.

More than 6 million Americans are living with dementia, and while there is no cure, patients can be helped by music.

Join CBS New York's Steve Overmyer in a tribute to winter in the Big Apple, when Christmas dreams and Hanukkah hopes brighten the skyline and warm our hearts even on the coldest nights.

Join us for a special Thanksgiving edition of stories of gratitude with CBS New York’s Steve Overmyer.

Get ready for a spine-chilling adventure as we delve into the world of the supernatural!

One man is making it his mission to give the heart of New York a heartbeat.

The CBS New York Book Club is celebrating indie bookstores with the help of Bookshop.org.

"Finding Margaret Fuller" has been chosen as our next read for the CBS New York Book Club with Mary Calvi.

After thousands of votes were cast for the CBS New York Book Club's Top 3 FicPicks, "Finding Margaret Fuller" is the next read.

After thousands of votes were cast for the CBS New York Book Club's Top 3 FicPicks, "Finding Margaret Fuller" is the next read.

They discussed Cheeks' book "Acts of Forgiveness."

Meet freshman Luke Kugler and sophomore Gabriella Sherlock, who are dominating here at home and on the national level.

CBS New York's Chris Wragge spent the morning at the school that has everything from a fencing program to 3D printing.

Class Act with Chris Wragge heads to Long Island tomorrow for a live look at the school and its students.

CBS New York's Chris Wragge will be live from the high school this Friday morning.

CBS New York's Chris Wragge will be live at the Long Island high school this Friday morning.

This Friday, our morning show will be live from Oyster Bay High School in Nassau County.

CBS New York's Class Act with Chris Wragge is live this morning from the nearly-century-old school.

Arts High School of Newark has been around for nearly a century, and it's a school where dreams come true -- not for a few, but for many.

Be sure to join us Friday, when we'll be live all morning from Newark Arts High School.

Need internet at your new home ASAP? Here's how to set up a simple, painless transfer that'll have you online in no time.

Before you make the big move to the Big Apple, make sure your new home internet is the fastest, and offers the best value.

Want to keep your internet when you move? You may be able to transfer service instead of canceling outright.

Columbia University President Dr. Minouche Shafik is testifying about antisemitism on college campuses before the House Committee on Education and the Workforce.

Due to budget cuts and growing class sizes, some New York City parents have chosen to take their children out of public schools, to give their kids a more individualized education.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

Craig Ross Jr. faces sentencing for kidnapping and sexually abusing a 9-year-old girl last fall at Moreau State Park in Saratoga County, New York.

A 13-year-old girl from Brooklyn has been charged with criminal possession of a weapon after she allegedly accidentally shot her 11-year-old brother, police sources tell CBS New York.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

We're in for another sunny and pleasantly warm afternoon, but not as warm as yesterday. Highs will be in the low 70s.

Today will be sunny with highs in the mid to upper 70s, possibly even 80 inland. Late showers are possible south of the city.

Damaging wind gusts are the main threat, but we can't rule out small hail or an isolated tornado northwest of NYC.

Thousands lined the streets of downtown Hartford on Saturday to celebrate UConn's second straight NCAA men's basketball championship, and sixth in 25 years.

Today will be at least 10 degrees cooler than yesterday, with a little rain developing in the afternoon.

Emergency crews worked all night to clear debris from tractor trailer crash above Elizabeth Avenue.

We're in for another sunny and pleasantly warm afternoon, but not as warm as yesterday. Highs will be in the low 70s.

Crews are working to reopen the roadway after part of a retaining wall collapsed onto the New Jersey Turnpike.

The statue of A. Philip Randolph in Newark is one of only three of the civil rights icon in the U.S.

Suspected Gilgo Beach serial killer Rex Heuermann is appeared in court in Suffolk County, Long Island.

More 55-gallon drums containing waste petroleum and chlorinated solvents have been found buried in Bethpage Community Park.

Lindy Jones pleads not guilty in last month's deadly shooting of NYPD Det. Jonathan Diller in Far Rockaway, Queens.

Many New Yorkers fear more fallout from escalating tensions between Israel and Iran. For now, there's extra police outside Jewish institutions as all pray for a peaceful future.

Jake's 58 expansion is expected to double betting terminals to 2,000 and more than triple the number of parking spaces.

Columbia University President Dr. Minouche Shafik is testifying about antisemitism on college campuses before the House Committee on Education and the Workforce.

Sen. Bob Menendez heads to trial next month to fight charges that he traded his political influence for cash, gold bars and a luxury car.

New York City health officials are warning of a worrisome increase in the number of leptospirosis cases from contact with rat urine.

Seven Manhattan residents were selected Tuesday afternoon to serve on the jury in former President Donald Trump's criminal trial.

The operation against illegal street vendors in Jackson Heights on Monday was part of New York City's attempt to address quality-of-life issues

19 people have been stricken — including nine who have been hospitalized — after getting fake or mishandled injections in homes and spas, feds warn.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

Younger adults are aging faster, increasing their risk for early onset cancers. So which anti-aging techniques actually work?

Most worrisome gaps involve cancer chemotherapy drugs, ER medications and and therapies for ADHD.

Black women are three times more likely to die from a pregnancy-related cause than white women, according to the CDC.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

The coming-of-age story is a favorite for generations of middle and high school students, and they're returning to it on Broadway.

CBS New York's Steve Overmyer met Ed Alstrom, the organ player who has been hyping up Yankees fans in the Bronx for over 20 seasons.

Eleanor documented much of the chaos on "Apocalypse Now" in what would become one of the most famous making-of films about moviemaking, 1991's "Hearts of Darkness: A Filmmaker's Apocalypse."

Vladimir Guerrero Jr. reached base four times and had two RBIs, Yusei Kikuchi pitched six sharp innings to win for the first time this season and the Toronto Blue Jays beat the Yankees 5-4, handing New York its third consecutive loss.

Jose Hernandez balked home the go-ahead run in the seventh inning, Jeff McNeil added an RBI double and the New York Mets beat the Pittsburgh Pirates 3-1.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

Knicks superfan Anthony Donahue says he expects to travel with the team as long as they are alive in the NBA playoffs.

How far the Rangers go in the postseason will almost certainly depend on Artemi Panarin continuing his brilliance.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

While many are excited about the idea of a state-of-the art skate park in Brooklyn, one of the largest on the East Coast, others oppose the location chosen.

East Harlem community leaders say the state oversaturated the neighborhood with methadone and other drug treatment centers as most patients live elsewhere.

President Joe Biden dropped in virtually to speak at the National Action Network convention Friday, breaking down his efforts to reduce the burden on Black people and boost opportunities for their success.

From eating cash to long lines, subway riders in Queens say their MetroCard machines are a mess.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The 50th Annual Village Halloween Parade drew massive crowds, celebrating the theme "Upside/Down:Inside/OUT."

As much of the northeast experiences heavy rains, parts of New York City are beginning to flood.

Thousands of people flooded Union Square on Friday for a PlayStation giveaway promoted by livestreamer Kai Cenat.

A crane went up in flames high above Manhattan, then partially collapsed onto the street below.

It was a brief appearance at Suffolk County Supreme Court in Riverhead. Heuermann wore a suit and tie and had his hands cuffed behind his back. His estranged wife was also there. CBS New York's Mary Calvi reports.

Columbia University President Dr. Minouche Shafik is testifying before Congress, as part of ongoing hearings about antisemitism on school campuses. CBS New York's Jessica Moore reports from the newsroom.

CBS New York's Tony Aiello has more on the investigation in Pomona, N.Y.

From libraries to schools, almost every public service in New York City has seen significant budget cuts this year. So what do those cuts look like for early childhood education.

Nearly 200,000 men and women leave the military every year, and some need help reacclimating. Now two veteran organizations are teaming up to help those who served stay ahead of potentially serious problems.